Archived General Blog Posts

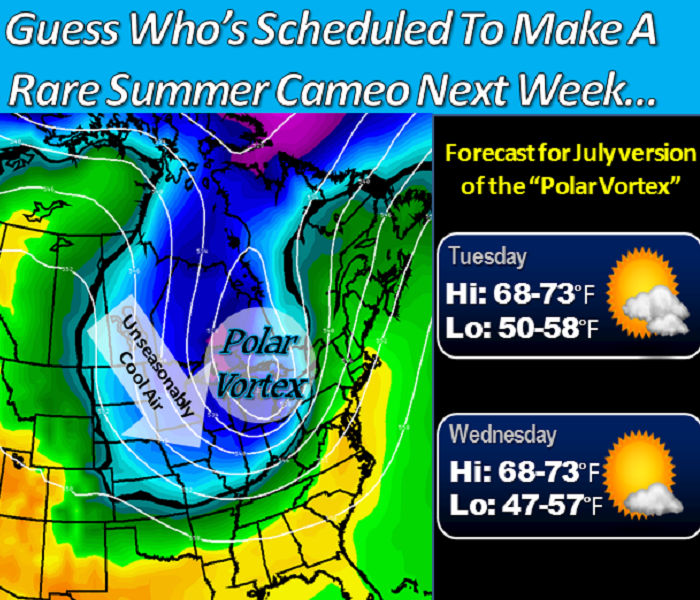

What the Polar Vortex Means for Your Pipes

1/15/2024 (Permalink)

Polar Vortexes bring exceedingly cold temperatures

Polar Vortexes bring exceedingly cold temperatures

As the winter weather continues, "Polar Vortexes" become far more likely, signaling plummeting temperatures and severe weather conditions. This meteorological term, often associated with bone-chilling cold, can have a profound impact on daily life, particularly for homeowners and business owners. In addition to several drops in temperature to worry about, polar vortexes also heavily affect plumbing systems. As temperatures dive, the risk of pipes freezing and subsequently bursting increases, potentially leading to severely damaging water floods. Understanding the polar vortex, how it affects plumbing piping, and the necessary preventive measures are essential for bracing for the winter months. SERVPRO of Great Neck and Port Washington has crafted some preventive measures you can utilize to ensure your plumbing stays safe during the ongoing polar vortex.

Understanding the Polar Vortex and Its Impact

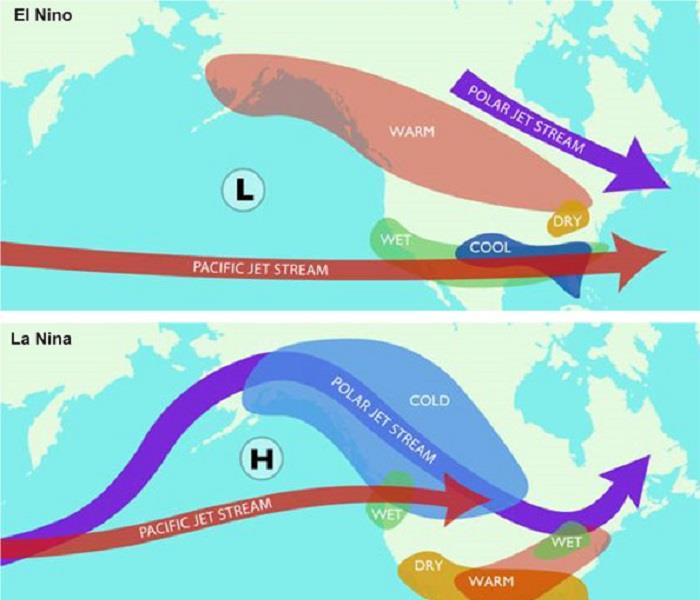

A polar vortex is essentially a vast expanse of swirling cold air that typically envelopes the polar regions. However, during the winter, the vortex at the North Pole often expands, pushing frigid air toward the equator and affecting much of the Northern Hemisphere. This shift can result in a sudden and steep drop in temperatures, often catching businesses and residences off-guard.

The critical issue with these plummeting temperatures is their effect on water pipes. Water expands when it freezes, and this expansion can exert extraordinary pressure on pipes, regardless of whether they are made of metal or plastic. When the pressure becomes too great, pipes can burst, leading to water damage, the potential for mold growth, and the need for repairs on top of restoration and cleaning services.

Prevention and Protection

To mitigate the risks of a polar vortex freezing your pipes, consider the following preventive steps:

- Insulate Pipes: Wrapping exposed pipes in foam insulation, particularly those in unheated areas like basements, attics, and garages, can significantly reduce the risk of freezing.

- Maintain Consistent Indoor Temperature: Keeping your home heated consistently, even when you're away, helps keep the internal temperature of pipes above freezing.

- Allow Faucets to Drip: Allowing a slight drip in faucets can prevent pressure buildup within pipes, reducing the risk of freezing and bursting.

- Drain Water from Pools and Sprinklers: Drain water from the swimming pool and sprinkler supply lines following the manufacturer's instructions.

- Close Inside Valves Supplying Outdoor Hose Bibs: After removing and draining outdoor hoses, close the inside valves that supply these bibs but leave the outside valve open.

- Insulate Vulnerable Spaces: Increase insulation in areas like attics, basements, and crawl spaces to maintain higher temperatures.

- Open Cabinet Doors: Allow warmer air to circulate around plumbing by opening kitchen and bathroom cabinet doors.

The polar vortex, while a natural weather phenomenon, poses a significant challenge to plumbing, particularly regarding the risk of frozen and bursting pipes. By understanding this meteorological event and taking proactive, preventative measures, you can safeguard your home against the potentially devastating and costly consequences. Prevention actions are far more effective and less costly than repair. Stay warm, stay informed, and prepare your home for whatever the winter brings.

Should you incur any water or storm damage during the Polar Vortex, feel free to contact SERVPRO of Great Neck and Port Washington, and we'll make it "Like It Never Even Happened!"

Happy Spring From SERVPRO of Great Neck/Port Washington! Don't let odors get you down

3/23/2017 (Permalink)

Spring has just arrived here on Long Island, NY and we at SERVPRO of Great Neck/Port Washington couldn't be happier!

Spring is all about new growth, clean new starts! So when LI clients call us about smells and odors, we are happy to help bring spring freshness back, no matter what the season or the reason!

Quick fixes and topical sprays only work on temporary odors - odors maybe from something that was just cooked or from a project or activity that you just did. They last a few minutes to a few hours.

Long lasting odors have settled in to stay at times because the conditions that caused the odor still exist and at times because the substance have settled deeply into the fibers and materials - leaving microscopic residue on surfaces and in hard-to-reach places. You may even have found that once you've cleaned a spot over and over, the odor keeps coming back despite all of your efforts.

SERVPRO of Great Neck/Port Washington knows that bad odors long term can be annoying, unpleasant and at times unhealthy. We are here to help!

Depending on the nature, source and type of the odor, we have techniques, products and equipment that our teams of trained professionals can implement to clean and destroy those odors for good! Odors may be from smoke/soot from fire, cigarettes/cigars, food smells, pet odors, garbage and hording, decomposing materials or animals, mold, spoiled food, raw sewage and more.

Remember SERVPRO of Great Neck/Port Washington - we will make it "Like it never even happened."

April Showers Bring....Floods and Sewage BackUps

4/12/2016 (Permalink)

Early spring rainfall has the potential to become a flooding risk factor. Once ground waters rise to the point that the soil becomes fully saturated, it leaves nowhere for excess water to go.

This can occur anywhere, including low to moderate flood risk areas - as saturated soil can cause catastrophic situations with septic systems.

SERVPRO of Great Neck/Port Washington understands the stress and worry that comes with a fire or water damage and the disruption it causes your life and home or business. Our goal is to help minimize the interruption to your life and quickly make it "Like it never even happened" by restoring your property back to pre-loss condition, ready for your contractor to refinish if demolition was a part of your service. SERVPRO is on over 400 insurers referral lists - we are a name you can trust.

SERVPRO of Great Neck/Port Washington specializes in the cleanup and restoration of residential and commercial property after a fire, smoke or water damage. SERVPRO of Great Neck/Port Washington can also mitigate mold and mildew from your home or business, remove odors, and dry out documents and books that have been water damaged.

Our staff is highly trained in property damage restoration. From initial and ongoing training at SERVPRO’s corporate training facility to regular IICRC-industry certification, rest assured our staff is equipped with the knowledge to restore your property. With a nationwide system of qualified franchises, no damage is too large or too small for SERVPRO of Great Neck/Port Washington.

If you would like to schedule service for your home or business, please call today 516-767-9600!

Have an Emergency? Don't delay - waiting can make your loss larger. For priority service, call us 24/7 at 516-767-9600.

Serving you since 1967, SERVPRO is the cleaning and restoration brand you know and trust.

Call SERVPRO of Great Neck/Port Washington for Mold Remediation

3/10/2016 (Permalink)

When you have water damage, don't wait - call 516-767-9600 before mold sets in and creates a bigger problem!

When you have water damage, don't wait - call 516-767-9600 before mold sets in and creates a bigger problem!

Don't let mold take over your home or building! We are here to help.

<b>SERVPRO of Great Neck/Port Washington<b> understands the stress and worry that comes with a fire or water damage and the disruption it causes your life and home or business. Our goal is to help minimize the interruption to your life and quickly make it "Like it never even happened" by restoring your property back to pre-loss condition, ready for your contractor to refinish if demolition was a part of your service. SERVPRO is on over 400 insurers referral lists - we are a name you can trust.

<b>SERVPRO of Great Neck/Port Washington<b> specializes in the cleanup and restoration of residential and commercial property after a fire, smoke or water damage. <b>SERVPRO of Great Neck/Port Washington<b> can also mitigate mold and mildew from your home or business, remove odors, and dry out documents and books that have been water damaged.

Our staff is highly trained in property damage restoration. From initial and ongoing training at SERVPRO’s corporate training facility to regular IICRC-industry certification, rest assured our staff is equipped with the knowledge to restore your property. With a nationwide system of qualified franchises, no damage is too large or too small for <b>SERVPRO of Great Neck/Port Washington<b>.

If you would like to schedule service for your home or business, please call today 516-767-9600!

<b>Have an Emergency? <b> Don't delay - waiting can make your loss larger. For priority service, call us 24/7 at 516-767-9600.

Serving you since 1967, SERVPRO is the cleaning and restoration brand you know and trust.

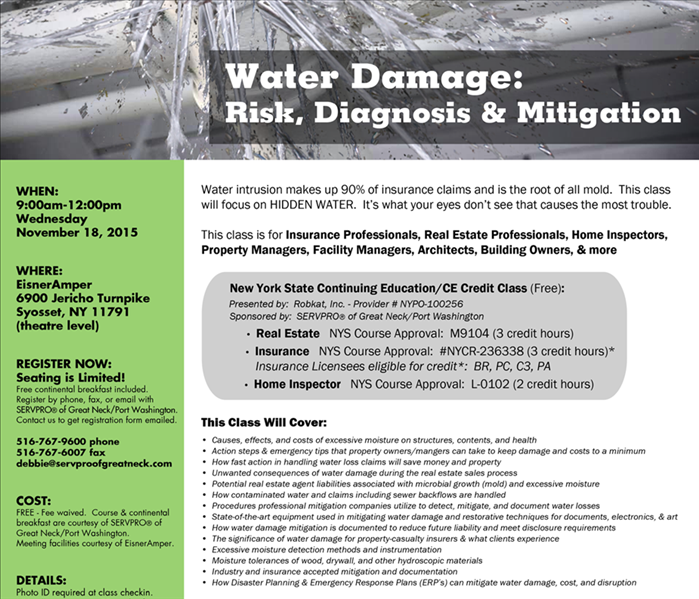

FREE Continuing Education Class - Nov. 18th, 2015

9/22/2015 (Permalink)

REGISTER: Call 516-767-9600 SERVPRO of Great Neck/Port Washington to reserve a space - seating is limited.

WHAT: "WATER DAMAGE: RISK, DIAGNOSIS & MITIGATION"

This is a FREE Continuing Education/CE Class (credits for licenses listed below). Includes a free breakfast!

COST: FREE - courtesy of SERVPRO of Great Neck/Port Washington

WHEN: Wednesday, November 18th, 2015 from 9:00am-12:00pm

WHERE: EisnerAmper; 6900 Jericho Turnpike; Syosset, NY 11791 (Theatre Level) - Space hosted by EisnerAmper.

WHO: Anyone may attend but CE credits are for Insurance Professionals, Real Estate Professionals, & Home Inspectors (see details below). We welcome Property Managers, Facility Managers, Architects, Building Owners, & more.

Water intrusion makes up 90% of insurance claims and is the root of all mold. This class will focus on HIDDEN WATER. It’s what your eyes don’t see that causes the most trouble.

This class is for Insurance Professionals, Real Estate Professionals, Home Inspectors, Property Managers, Facility Managers, Architects, Building Owners, & more (continuing education credits apply to only to the fields listed below - but anyone may attend.)

New York State Continuing Education/CE Credit Class (Free): Presented by: Robkat, Inc. - Provider # NYPO-100256 Sponsored by: SERVPRO® of Great Neck/Port Washington

• REAL ESTATE Course Approval: M9104 (3 credit hrs)

• INSURANCE Course Approval: #NYCR-236338 (3 credit hrs)*

Note: Insurance Licensees eligible for credit*: BR, PC, C3, PA

• HOME INSPECTOR Course Approval: L-0102 (2 credit hours)

This Class Will Cover:

• Causes, effects, and costs of excessive moisture on structures, contents, and health

• Action steps & emergency tips that property owners/mangers can take to keep damage and costs to a minimum

• How fast action in handling water loss claims will save money and property

• Unwanted consequences of water damage during the real estate sales process

• Potential real estate agent liabilities associated with microbial growth (mold) and excessive moisture

• How contaminated water and claims including sewer backflows are handled

• Procedures professional mitigation companies utilize to detect, mitigate, and document water losses

• State-of-the-art equipment used in mitigating water damage and restorative techniques for documents, electronics, & art

• How water damage mitigation is documented to reduce future liability and meet disclosure requirements

• The significance of water damage for property-casualty insurers & what clients experience

• Excessive moisture detection methods and instrumentation

• Moisture tolerances of wood, drywall, and other hydroscopic materials

• Industry and insurance accepted mitigation and documentation

• How Disaster Planning & Emergency Response Plans (ERP’s) can mitigate water damage, cost, and disruption

Our Top 30 Hurricane Preparedness Tips For Facilities & Properties

7/14/2015 (Permalink)

#1 Check and secure items on roofs (antennas, fans, turbines, covers, HVAC units), yards, and in open vehicles to prevent items from going airborne or suffering flood damage.

#2 Have clean up/board up materials and PPE Personal Protective Equipment on hand - including protective eyewear, gloves, respirators, dust masks, hammer, nails, drill, screws, plywood, furring items that can become strips, ladder, heavy duty plastic sheeting (4mm or thicker), brooms, mops, pails, trash bags - note that we offer 24/7 board up/clean up service if needed

#3 Distribute an emergency contact list for all staff or tenants and let everyone know in advance how communication will occur

#4 Develop emergency staff assignments to predetermine chain of command - who will perform what, where, and how

#5 Minimize flood losses - relocate critical systems above flood levels and move at risk items - interior equipment, furnishings, or documents to higher or safer locations - as much as 90% of property damage caused by all natural disasters is a result of flooding

#6 Make sure any flood prone areas are clear of electrical hazards that could energize water and injure someone

#7 Ensure all emergency lighting is operational

#8 Brace and secure any roll up doors

#9 Have emergency contact numbers for your local police, fire, rescue, area hospitals, and your insurance agents

#10 Do a risk assessment - identify potential threats to your building due to your location and environment - periodically walk and photograph your facility and vital contents for your insurance adjustor, backing up off-site

#11 Have mobile devices charged at all times and have a power plan for extended outages

#12 The FCC recommends limiting non-emergency calls that congest and overwhelm networks during crisis - text instead

#13 Make sure interior building emergency exit paths are clear and doors are not blocked, locked, or chained

#14 Review your company's Disaster Management Plan, they are often required by OSHA for employees (who has a free eTool) - and contact us to do a free Emergency Ready Profile for your building

#15 Shut off non-essential electrical equipment and protect vital digital data, equipment, and software programs with UPS - Uninterruptible Power Supply

#16 Trim all trees and bushes to make them more wind resistant

#17 Have generators maintained regularly, and keep adequate fresh fuel on hand

#18 Make sure all or key members of staff know how and where to turn off the main power, switch boxes, water, gas, and equipment in emergencies (this info is detailed in our ERP)

#19 Notify your key suppliers, vendors, shippers, customers, and contractors if there is a disruption in your area or an alternate plan, and even if you were not affected - as they may be concerned if the event is in the media

#20 If you have critical vendors that you use, see if they have a disaster plan and contingencies should they experience a disruption themselves so your operations are not affected

#21 Review your insurance policies to determine what disasters you have coverage for and what is not covered, seek out supplemental insurance if necessary

#22 Keep staff first aid training current - know who has medical or volunteer firefighter and EMT training

#23 Have alternative space arrangements in place or at least in mind if you need to operate the business elsewhere if your facility is temporarily disabled

#24 Back up your data, 30% of all businesses that back up their data now do so because they have lost data before

#25 Sign up for emergency alerts and apps to your cell phone

#26 Develop and maintain an evacuation plan for your facility, conducting periodic drills for staff

#27 Create a security procedure for a damaged facility to control access in order to protect property and assets

#28 Check water supply for contamination after an event

#29 Make sure any hazardous materials are safely contained

#30 Have a go-to list of qualified professionals to use for the inspection of the building's stability, systems, and equipment (including air safety and electrical) after an event to ensure all are safe and operational for employees to return and use

SERVPRO of Great Neck – Port Washington is located on Long Island, in New York.

Northeast in Deep Freeze as Record Low Temps are Set

2/20/2015 (Permalink)

PHILADELPHIA — Arctic air and bitterly cold wind is moving across the Northeast, plunging temperatures into record low single digits, accompanied by subzero wind chills.

The National Weather Service says Friday’s extreme weather brought record low temperatures from western Pennsylvania to New York City and on into Connecticut, forcing a number of school closures

In western Pennsylvania, temperatures dipped to minus 18 in New Castle, minus 15 in Butler and 6 below zero in Pittsburgh — all records.

At Newark Liberty International Airport in New Jersey it was 1 degree Friday, beating the record of 5 set in 1936. Trenton’s temperature fell to zero and beat the low of 6 set in 1936. In sections of the state, wind chills reached 10 to 20 degrees below zero.

In New York City’s Central Park, the temperature hit a record 2 degrees, beating the previous low of 7 in 1950.

Preventing and Thawing Frozen Pipes

2/16/2015 (Permalink)

Reprinted from www.redcross.org

Being prepared and informed may help you to avoid the messy and often expensive issue of frozen pipes. The American Red Cross provides information and suggestions around how to prevent water pipes in the home from freezing, and how to thaw them if they do freeze.

Why Pipe Freezing is a Problem

Water has a unique property in that it expands as it freezes. This expansion puts tremendous pressure on whatever is containing it, including metal or plastic pipes. No matter the "strength" of a container, expanding water can cause pipes to break. Pipes that freeze most frequently are those that are exposed to severe cold, like outdoor hose bibs, swimming pool supply lines, water sprinkler lines, and water supply pipes in unheated interior areas like basements and crawl spaces, attics, garages, or kitchen cabinets. Pipes that run against exterior walls that have little or no insulation are also subject to freezing. Before the onset of cold weather, prevent freezing of these water supply lines and pipes by following these recommendations:- Drain water from swimming pool and water sprinkler supply lines following manufacturer's or installer's directions. Do not put antifreeze in these lines unless directed. Antifreeze is environmentally harmful, and is dangerous to humans, pets, wildlife, and landscaping.

- Remove, drain, and store hoses used outdoors. Close inside valves supplying outdoor hose bibs. Open the outside hose bibs to allow water to drain. Keep the outside valve open so that any water remaining in the pipe can expand without causing the pipe to break.

- Check around the home for other areas where water supply lines are located in unheated areas. Look in the basement, crawl space, attic, garage, and under kitchen and bathroom cabinets. Both hot and cold water pipes in these areas should be insulated.

- Consider installing specific products made to insulate water pipes like a "pipe sleeve" or installing UL-listed "heat tape," "heat cable," or similar materials on exposed water pipes. Newspaper can provide some degree of insulation and protection to exposed pipes – even ¼” of newspaper can provide significant protection in areas that usually do not have frequent or prolonged temperatures below freezing.

During Cold Weather, Take Preventative Action - Keep garage doors closed if there are water supply lines in the garage.

- Open kitchen and bathroom cabinet doors to allow warmer air to circulate around the plumbing. Be sure to move any harmful cleaners and household chemicals up out of the reach of children.

- When the weather is very cold outside, let the cold water drip from the faucet served by exposed pipes. Running water through the pipe - even at a trickle - helps prevent pipes from freezing.

- Keep the thermostat set to the same temperature both during the day and at night. By temporarily suspending the use of lower nighttime temperatures, you may incur a higher heating bill, but you can prevent a much more costly repair job if pipes freeze and burst.

- If you will be going away during cold weather, leave the heat on in your home, set to a temperature no lower than 55° F.

- If you turn on a faucet and only a trickle comes out, suspect a frozen pipe. Likely places for frozen pipes include against exterior walls or where your water service enters your home through the foundation.

- Keep the faucet open. As you treat the frozen pipe and the frozen area begins to melt, water will begin to flow through the frozen area. Running water through the pipe will help melt ice in the pipe.

- Apply heat to the section of pipe using an electric heating pad wrapped around the pipe, an electric hair dryer, a portable space heater (kept away from flammable materials), or by wrapping pipes with towels soaked in hot water. Do not use a blowtorch, kerosene or propane heater, charcoal stove, or other open flame device.

- Apply heat until full water pressure is restored. If you are unable to locate the frozen area, if the frozen area is not accessible, or if you can not thaw the pipe, call a licensed plumber.

- Check all other faucets in your home to find out if you have additional frozen pipes. If one pipe freezes, others may freeze, too.

- Consider relocating exposed pipes to provide increased protection from freezing.

- Pipes can be relocated by a professional if the home is remodeled.

- Add insulation to attics, basements and crawl spaces. Insulation will maintain higher temperatures in these areas.

- For more information, please contact a licensed plumber or building professional.

Tips to Managing Frigid Weather

2/13/2015 (Permalink)

Frigid weather is blasting the Tri-State Area, which means it is dangerous outside. Residents are urged to protect themselves and help others who may be at increased risk of health problems.

Tips to stay safe

--Stay indoors as much as possible

--Report any loss of heat or hot water to property managers immediately, and call 311 or your local authorities.

--If your home lacks heat, get to a warm place tonight if you can and wear extra layers of dry, loose-fitting clothing, hats and gloves to help stay warm.

--Never use a gas stove to heat your home.

--Never use a kerosene or propane space heater, charcoal or gas grill, or generator indoors or near the home.

--If a carbon monoxide detector goes off in your home, call 911, quickly open a nearby window, and go outside for fresh air immediately.

--When outdoors, wear warm clothing and cover exposed skin. Use multiple layers to maintain warmth.

--Seniors should take extra care outdoors to avoid slips and falls from icy conditions.

--Check on neighbors, friends, relatives and clients (if you are a service provider).

--If you need a prescription filled, do so today before the arrival of the snow and dangerously cold temperatures.

Check on Neighbors, Friends, Relatives and Clients

--Home visiting and social service agencies should activate their cold emergency plans, and reach out in advance to their clients to make sure they're aware of the cold and snow.

--If you are concerned about someone on the street who may be homeless and in need of assistance, call 311 or local authorities and ask for the Mobile Outreach Response Team. The Department of Homeless Services will send an outreach team to the location to assess the individual's condition and take appropriate action.

--If your building is cold, check on your neighbors. If you know someone who is vulnerable and lacking heat, help them get to warm places and notify the building manager and/or call 311 or your local utility to get heat restored. If you see someone with signs of hypothermia such as confusion, shivering, slurred speech, drowsiness call 911 for help and help the person get warm while waiting for help.

--Landlords and building managers should check their building systems to ensure heat, and check on vulnerable people.

Health problems resulting from prolonged exposure to cold include hypothermia, frostbite and exacerbation of chronic heart and lung conditions. Here are the signs and symptoms of hypothermia and frostbite:

--Hypothermia is a life-threatening condition where the body temperature is abnormally low. Symptoms may include shivering, slurred speech, sluggishness, drowsiness, unusual behavior, confusion, dizziness, and shallow breathing. Some people, such as infants, seniors, and those with chronic diseases and substance abuse problems can get sick quicker. Check on friends, relatives, and neighbors who may need assistance to ensure they are adequately protected from the cold.

--Frostbite is a serious injury to a body part frozen from exposure to the cold. It most often affects extremities like fingers and toes or exposed areas such as ears or parts of the face. Redness and pain may be the first warning of frostbite. Other symptoms include numbness or skin that appears pale, firm, or waxy.

Provide first aid

--If you suspect a person is suffering from frostbite or hypothermia, call 911 to get medical help.

--While waiting for assistance to arrive, help the person get warm by getting them to a warm place if possible, removing any damp clothing and covering them with warm blankets.

What to Do if You Lose Heat or Hot Water at Home

Take these measures to trap existing warm air and safely stay warm until heat returns, including:

--Insulate your home as much as possible. Hang blankets over windows and doorways and stay in a well-insulated room while the heat is out.

--Dress warmly. Wear hats, scarves, gloves, and layered clothing.

--If you have a well maintained working fireplace and use it for heat and light, but be sure to keep the damper open for ventilation. Never use a fireplace without a screen.

--If the cold persists and your heat is not restored call family, neighbors, or friends to see if you can stay with them.

--Do not use your oven or fuel-burning space heaters to heat your home. These can release carbon monoxide, a deadly gas that you cannot see or smell.

--Open your faucets to a steady drip so pipes do not freeze.

Safe Home Heating Tips

Improper use of portable heating equipment can lead to fire or dangerous levels of carbon monoxide. Take precautions to ensure you are heating your home safely.

Fire safety tips:

--Make sure you have a working smoke alarm in every room. Test them at least once a month and change the batteries twice a year.

--Use only portable heating equipment that is approved for indoor use. Space heaters are temporary heating devices and should only be used for a limited time each day.

--Keep combustible materials, including furniture, drapes, and carpeting at least three feet away from the heat source. Never drape clothes over a space heater to dry them.

--Never leave children alone in the room where a space heater is running. Always keep an eye on heating equipment. Turn it off when you are unable to closely monitor it.

--Plug space heaters directly into a wall outlet. Never use an extension cord or power strip. Do not plug anything else into the same outlet when the space heater is in use. Do not use space heaters with frayed or damaged cords.

--If you are going to use an electric blanket, only use one that is less than 10 years old from the date of purchase. Also avoid tucking the electric blanket in at the sides of the bed. Only purchase blankets with an automatic safety shut-off.

Carbon monoxide safety tips:

--Carbon monoxide comes from the burning of fuel. Therefore, make sure all fuel-burning devices such as furnaces, boilers, hot water heaters, and clothes dryers are properly vented to the outdoors and operating properly. If you are not sure, contact a professional to inspect and make necessary repairs.

--Make sure you have a working carbon monoxide detector. Most homes and residential buildings in New York City are required by law to have carbon monoxide detectors installed near all sleeping areas. Owners are responsible for installing approved carbon monoxide detectors. Occupants are responsible for keeping and maintaining the carbon monoxide detectors in good repair.

--If you have a working fireplace keep chimneys clean and clear of debris.

--Never heat your home with a gas stove or oven, charcoal barbecue grill, or kerosene, propane, or oil-burning heaters.

--The symptoms of carbon monoxide poisoning are non-specific and include headache, nausea, vomiting, dizziness, sleepiness, trouble breathing, and loss of consciousness. Severe poisonings may result in permanent injury or death.

If you suspect carbon monoxide poisoning, call 911, get the victim to fresh air immediately, and open windows.

If You Need Emergency Heating Assistance

The Human Resources Administration (HRA) administers the federal Home Energy Assistance Program (HEAP), which provides low-income people with emergency heating assistance. Eligible residents will receive a payment for fuel delivery, or HRA will arrange for fuel delivery or boiler repair. Emergency assistance is given to those who qualify only once per heating season. Call 311 for more information.

Homeless Outreach

The Department of Homeless Services (DHS) continues to use its Cold Weather Emergency Procedure, called Code Blue, to protect unsheltered individuals, who are more at risk for exposure deaths during the cold winter months.

Outreach workers are on the streets 24 hours a day, seven days a week and are trained to:

--Identify and regularly monitor individuals who may be at risk during cold weather.

--Engage at-risk individuals and persuade them to voluntarily come indoors.

During a Code Blue Cold Weather Emergency, housing options for the homeless include the following:

Shelters: During a Code Blue, homeless adults can access any shelter location for single individuals. Beds are available system-wide to accommodate anyone brought in by outreach teams or walk-ins.

Drop-in centers: All drop-in centers are open 24 hours a day when Code Blue procedures are in effect, taking in as many as people as possible for the duration of inclement weather. Drop-in staff also can make arrangements for homeless individuals at other citywide facilities.

Safe havens and stabilization beds: Chronically homeless individuals may be transported to these low-threshold housing options where they may go directly from the street to a bed.

Winter Maintenance Tips

2/11/2015 (Permalink)

Winter Weather Tips

You worked hard this past holiday season; your house guests are gone, the decorations have all been packed away and you’re settling into the New Year. For those who live in an area of the country with a nice, warm climate, their Winter preparations mean putting on a sweater at night or taking that extra minute to jump into the pool! However, for those of us who live in the “hearty” Northeast where temperatures dip and snow begins to fall, there are cold weather preparations that will not only keep your home and property safe, but may also save you a few dollars.

Clean It - Start the winter with a clean furnace - a cleaner furnace can save up to 5% of fuels costs over the course of the year compared to a dirty one. And with this season’s lower than expected oil prices, filling up your tank will be more affordable.

Avoid ice damming by keeping gutters clear of leaves, sticks and other debris to ensure melting snow can drain properly. If the snow refreezes, it can lead to water damage inside your home or possibly even a roof collapse.

Seal It – Keep cold air out and warm air in this winter. Grab a tube of caulk and take a walk around your home to seal any openings around windows, doors, vents and electrical wires. Also sealing any openings will prevent mice from sneaking in to enjoy your warm winter air!

Remove hoses, turn off outside water and tighten outside faucets as pipes can burst if water in the pipe freezes. And during a deep freeze, remembering to drip your inside faucets ever so slightly will greatly eliminate the risk of inside pipes bursting.

Check It – Check smoke detectors, fire alarms, carbon monoxide detectors and flashlights to ensure they are operating properly. Have extra batteries on hand and replace if necessary.

Keep a cache of candles on hand but when in use keep the flame away from flammable items and never leave them unattended. Same goes for a portable space heater!

Store It – Having a supply of warm blankets in the linen closet, bottled water in the pantry and ice melting compound in the garage is always a good idea. And keeping a small bucket of sand and a shovel handy inside your home will be most helpful . . . especially if Old Man Winter brings a foot of snow to your door!

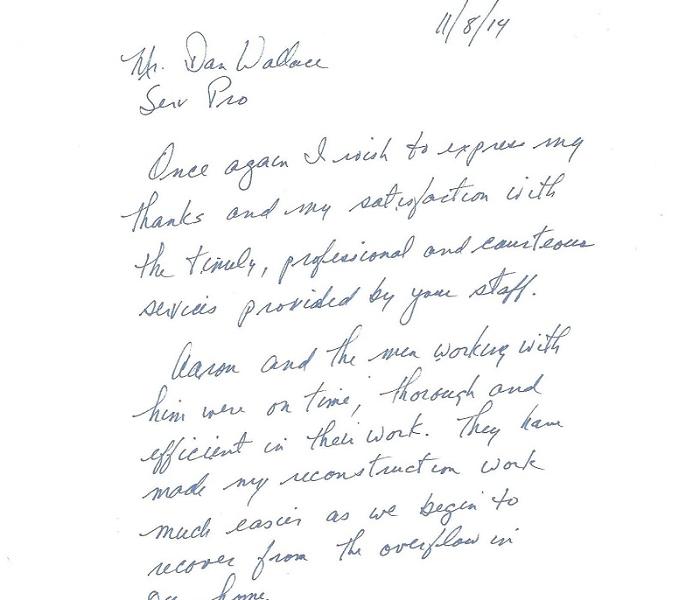

We Couldn't Be Prouder! Another Great Customer Testimonial - Please Read

2/5/2015 (Permalink)

Capital One Bank

170 Tulip Avenue

Floral Park NY 11001

February 4, 2015

Having been in the Property Management business for the past 15 years, I have seen my fair share of issues; from fires, to floods, to mold, etc. Each situation is unique and requires a different approach to remediation. Working for a financial institution, I can tell you that the need for a speedy resolution is as important as the need for a thorough one. After a disaster, not only do we need to re-open as quickly as possible to serve our clients, we are responsible for providing a safe, healthy environment for all associates, and that is where SERVPRO comes in.

I have had the pleasure of working with Debbie Rashti and Dan Wallace on several occasions. The first was when one of our bank branches experienced several severe leaks as the result of negligence from a neighboring business. After performing an indoor air quality test, it was determined that a highly dangerous form of mold was growing in our ceiling and inside the walls. On a Thursday morning, we reached out to SERVPRO for assistance. Within 24 hours, Debbie and Dan had a team mobilized and ready to work around the clock for the next 72 hours in order to rid our branch of this toxic substance and make it ready to safely re open to customers on a Monday morning, with a favorable air quality test. The task was performed seamlessly and with such organization, that one would never be able to tell on that Monday morning, that just a day before, the space had been filled with a massive team, opening ceilings and walls to perform such a detailed remediation.

Another instance that will forever stand out in my mind is the days that followed the devastation of Hurricane Sandy in October of 2012. Capital One had more than 10 branches that suffered significant damage as a result of the storm, making them unable to open for business. In addition to mere loss of electricity, some of our locations suffered from significant flooding and one in particular, from fuel oil contamination, when an oil tank broke apart in the basement as a result of massive flooding.

The day after the storm, Dan Wallace began touring with Capital One Property and Project Managers, myself included, in order to survey these badly damaged locations and determine what was needed to re-open. Once each survey was completed, Dan wasted no time putting a team together to begin remediation. Dan took total control of, what at first seemed like an impossible task, and set a clear, organized plan in motion. With SERVPRO’s expertise, organization and professionalism, Capital One was able to open many of its damaged sites, within days and weeks, rather than months, as was the case with many neighboring businesses.

I can’t possibly give the team at SERVPRO the proper amount of praise they deserve. They have been, and will continue to be an asset to Capital One Bank and many other organizations time and time again. SERVPRO is amazing.

Facility Manager

Jones Lang LaSalle for Capital One Bank

Homeowners Insurance Rates: How Does Your State Compare?

2/3/2015 (Permalink)

Reprinted from PropertyCasualty 360

NAIC 2012 annual homeowners insurance report shows it’s about location first.

The most important factor when buying real estate is location, and as you might expect, it’s a significant factor in establishing rates for homeowners insurance as well. What is the average premium for a house worth $300,000 in Georgia compared to one in neighboring Alabama or Florida? What’s the average nationwide?

Panelists at the Property/Casualty Insurance Joint Industry Forum 2015 on Jan. 13 acknowledged downward pressure on rates, especially for homeowners policies because they aren’t seeing much growth in new home sales. With that trend in mind, if you’re pricing policies and renewals in different locations, it’s helpful to know what the most recent data on the cost of homeowners policies shows.

The National Association of Insurance Commissioners (NAIC) released its 2012 Homeowners Insurance Report on Jan. 20, providing detailed data on market distribution and the average cost by policy form and insurance amount of homeowners insurance across the U.S. The report provides countrywide and state-specific premium and exposure information for standard noncommercial dwelling fire insurance and for homeowners insurance package policies (HO-1, HO-2, HO-3, HO-5 and HO-8), tenant policy HO-4, and condominium/cooperative unit owner’s policy HO-6.

The 2012 report, available for free download on the NAIC website, includes some interesting statistics as well as detailed charts.

In 2012, homeowners owner-occupied policy exposures accounted for 76.8% of overall exposures countrywide.Tenant and condominium policy exposures accounted for 21.3% of the total, while dwelling fire exposure made up the remaining 1.9%.Approximately 53.2% of policies sold in Washington, D.C. in 2012 were tenant or condo/co-op policies, reflecting the high level of urbanization.Here are several key factors affecting the cost of insurance that also were identified in the report.

Geographic areas. Generally, the more densely populated the location, the higher the real estate values and construction costs. You’ll also find relatively higher real estate values in vacation and retirement areas.Construction costs. The type of residence, the availability of building materials, local climate and building regulations all affect construction costs. Premiums also reflect higher expected repair costs for designs intended to reduce structural damages from earthquakes or hurricanes, for example.Degree of exposure to catastrophe. Homeowners insurance premiums also are affected by the degree of exposure to catastrophes, for example, a waterfront property exposed to hurricanes or a mountaintop property exposed to brush and forest fires. According to the Property Claims Services unit of the Insurance Services Office, an event is a catastrophe if it results in insured losses that total $25 million or more.Stricter building codes. After major catastrophes like Hurricane Katrina or Superstorm Sandy many state and local governments enact stricter building codes in an attempt to minimize damage and losses from future catastrophes.Economic factors. Such economic factors as inflation increase the amount of insurance premiums over time. Interest rates and inflation can affect not only the value of the real estate and building but also the price of the insured contents.These factors as well as others listed in the report can result in wide variations in premiums, not only by region or state, but on local levels as well. It pays to shop around, and consult your agent or broker for the best policy for your location.

Is Your Home Office Covered by Your Homeowners Insurance? Here's What You Need to Know

1/29/2015 (Permalink)

Reprinted from PropertyCasualty360

Have you become an entrepreneur over the last year, running a home-based business? Or do you sell home products like make-up or plastic storage containers for extra income? If so, are you aware that your standard homeowners insurance policy may leave you with coverage gaps?

As Diane W. Richardson, CPCU, points out in the Home-Based Business Coverage Guide ((c)2015, National Underwriter Co.), there are both property and liability business exposures that most standard policies don’t address as well as low limits on coverage.

For example, most homeowners policies limit the amount of coverage available for property on the insured premises used primarily for business purposes. According to Richardson, the unendorsed Insurance Services Office (ISO) homeowners 2011 program provides only $2,500 for business property on the premises and $500 for business property away from the residence premises. The American Association of Insurance Services (AAIS) 2008 program limits are $2,500 and $250, respectively. When you add up the cost of your computer, all-in-one printer, fax and scanner, tablet, modem and router, telephone system, desk, filing cabinet, office supplies and software, you could easily exceed $2,500. And your smartphone by itself could cost more than $500 to replace.

Other structures

If you operate your business out of your garage or barn, you’ll need coverage for “other structures.” Homeowners policies vary in what coverage they provide for such structures, depending on whether they are used for storage of business property or actively used to conduct business.

Liability exposure

The ISO homeowners form 2011 excludes any activities “engaged in for money” for which you don’t earn more than $2,000 in the 12-months preceding the policy period from the definition of “business.” This limitation puts most home-based business owners within the “trade, profession or occupation engaged in on a full, part-time or occasional category” and so without coverage, Richardson explains.

Richardson also points out that there are potential gaps in coverage, depending on the business, which may include liability from a violation of any intellectual property laws, infringement of a copyright or trademark for anything on a Web site, errors and omissions exposures, or employers liability and workers’ compensation. In some situations, you may need specialized coverage—for example, professional liability insurance for attorneys or accountants. Richardson believes that, generally, the coverages of the ISO and AAIS forms are adequate—at least as a start, before you speak with your agent or broker.

Business income

What would happen if you couldn’t work out of your home office—if it’s destroyed by fire or you have no power for several days due to an ice storm? You would have no coverage for the loss of your business income without appropriately endorsing the homeowner form. Depending on the size of your business, you may have to purchase a businessowners or commercial policy with business interruption coverage. If your business takes over your home to the point at which you’ve converted all the rooms to offices and moved to another residence, then you’ll definitely need commercial coverage.

Exclusions from property coverage

Remember that your home-based business is attached to your homeowners coverage and is subject to the same exclusions. If your home isn’t covered by flood insurance, for example, neither is your business, Richardson explains. It’s also important to understand that the ISO and AAIS forms list different named perils, open perils, and exclusions. Richardson cites the example of sinkhole collapse as a named peril in the AAIS form but not in the ISO form. Both forms exclude coverage for any loss resulting from criminal or fraudulent acts.

The policies also include exclusions from liability coverage, for instance, an employer’s liability for injury to employees or bodily injury or property damage from pollution caused or created by the business. The AAIS form specifically excludes coverage of injury or damage of electronic data and computer failure.

Terms and conditions

The ISO and AAIS forms also include conditions on your homeowners declaration that apply to property losses under your home-based business insurance coverage, whether the property belongs to your business or to someone else. For example, if you repair computers or furniture for customers at your home, ask your broker whether damage to the customer’s property is covered. If so, you also should ask how the value of the property is calculated and how any potential loss will be settled.

Telecommuters

If you telecommute or work remotely for an employer, the insurance issues for a home office are even more complicated. For example, you may be covered under your homeowners policy for property you own, such as your desk and filing cabinets, but your employer may be covered for loss to company-owned property such as your computer or smartphone. If a delivery person slips on icy steps at your home while making a business-related delivery in this situation, your employer’s policy might cover, your homeowners policy might cover, or you could find yourself in the middle between the two carriers, both of which may initially deny the claim. If you serve a customer coffee in your kitchen—not your office—after a business meeting, and the customer is burned by hot coffee, there may be a question of shared liability because the kitchen isn’t officially business space.

If you do work remotely, be sure to check your homeowners policy and ask your employer to confirm what the terms and conditions of its policies are, or you may find that neither policy covers a loss.

Homeowner Insurance Rates: How Does Your State Compare?

1/22/2015 (Permalink)

Reprinted from PropertyCasualty360

NAIC 2012 annual homeowner insurance report shows it’s about location first.

The most important factor when buying real estate is location, and as you might expect, it’s a significant factor in establishing rates for homeowners insurance as well. What is the average premium for a house worth $300,000 in Georgia compared to one in neighboring Alabama or Florida? What’s the average nationwide?

Panelists at the Property/Casualty Insurance Joint Industry Forum 2015 on Jan. 13 acknowledged downward pressure on rates, especially for homeowner policies because they aren’t seeing much growth in new home sales. With that trend in mind, if you’re pricing policies and renewals in different locations, it’s helpful to know what the most recent data on the cost of homeowner policies shows.

The National Association of Insurance Commissioners (NAIC) released its 2012 Homeowners Insurance Report on Jan. 20, providing detailed data on market distribution and the average cost by policy form and insurance amount of homeowners insurance across the U.S. The report provides countrywide and state-specific premium and exposure information for standard noncommercial dwelling fire insurance and for homeowner insurance package policies (HO-1, HO-2, HO-3, HO-5 and HO-8), tenant policy HO-4, and condominium/cooperative unit owner’s policy HO-6.

The 2012 report includes some interesting statistics:

In 2012, homeowner owner-occupied policy exposures accounted for 76.8% of overall exposures countrywide.Tenant and condominium policy exposures accounted for 21.3% of the total, while dwelling fire exposure made up the remaining 1.9%.Approximately 53.2% of policies sold in Washington, D.C. in 2012 were tenant or condo/co-op policies, reflecting the high level of urbanization.Here are several key factors affecting the cost of insurance that also were identified in the report.

Geographic areas. Generally, the more densely populated the location, the higher the real estate values and construction costs. You’ll also find relatively higher real estate values in vacation and retirement areas.Construction costs. The type of residence, the availability of building materials, local climate and building regulations all affect construction costs. Premiums also reflect higher expected repair costs for designs intended to reduce structural damages from earthquakes or hurricanes, for example.Degree of exposure to catastrophe. Homeowners insurance premiums also are affected by the degree of exposure to catastrophes, for example, a waterfront property exposed to hurricanes or a mountaintop property exposed to brush and forest fires. According to the Property Claims Services unit of the Insurance Services Office, an event is a catastrophe if it results in insured losses that total $25 million or more.Stricter building codes. After major catastrophes like Hurricane Katrina or Superstorm Sandy many state and local governments enact stricter building codes in an attempt to minimize damage and losses from future catastrophes.Economic factors. Such economic factors as inflation increase the amount of insurance premiums over time. Interest rates and inflation can affect not only the value of the real estate and building but also the price of the insured contents.These factors as well as others listed in the report can result in wide variations in premiums, not only by region or state, but on local levels as well. It pays to shop around, and consult your agent or broker for the best policy for your location.

Insurance via Internet Is Squeezing Agents

1/19/2015 (Permalink)

Reprinted from The New York Times

To the list of jobs threatened by the Internet, add one more: insurance agent.

Technology start-ups, and companies from the insurance industry, are introducing websites that sell or promote a range of insurance including auto, homeowners and small commercial policies. These portals, which promise savings by showing consumers many price quotes so they do not have to shop site by site, are putting pressure on insurance agents, who collect 10 percent or more of their policyholders’ payments.

Online insurance comparison is still a nascent business, and it has yet to make a dent in the armies of intermediaries that are the backbone of the trade. But people in the industry and Silicon Valley say it is only a matter of time. Even Google is getting involved.

“There are 40,000 agencies in the U.S., and you could absolutely imagine them shrinking by a quarter, and the ones that are left will deal with more complicated needs and more affluent customers,” said Ellen Carney, an analyst who covers insurance for Forrester Research.

The idea of selling insurance online is not new. Lately, though, the boring but lucrative trade has been attracting big names. The most recent is Google.

Its Google Compare auto insurance site (basically a search engine for auto insurance prices) has been operating in Britain for two years, and Google is working on something similar for the United States. Google is licensed to sell insurance in about half of the states, according to research by Ms. Carney.

Google has formed a partnership with Comparenow, an American auto insurance comparison site owned by Admiral Group, a British car insurance company that has operated a European price-comparison site for more than a decade. The venture will give Google access to insurers in Comparenow’s network.

Admiral Group introduced Comparenow about a year ago. Not long after, Overstock.com, a retailer, started selling auto and other forms of insurance.

Then there is Walmart, which does not sell insurance but recently formed a partnership with AutoInsurance.com. The insurer leases space in Walmarts, giving it access to the 140 million people who shop there each week.

These companies are joining start-ups like CoverHound, a San Francisco company that allows consumers to compare and buy auto insurance online, and PolicyGenius, a Brooklyn company that sells products including life, renters and pet insurance.

Some companies, like CoverHound and PolicyGenius, are online insurance agencies. Others, like Comparenow, send traffic to insurers and get a finder’s fee whenever someone buys a policy. But in all cases, they are pressing Main Street agents by automating the process and showing insurers’ prices side by side.

“A lot of people are waking up to the fact that it’s a massive industry, it’s old-fashioned, they still use human agents and the commissions are pretty big,” said Jennifer Fitzgerald, the founder and chief executive of PolicyGenius. “It’s ripe for — I hate to use the word — disruption.”

Insurance is a fat target. In 2013, insurers wrote $481 billion in premiums for property and casualty insurance, which consists of mostly auto, home and commercial insurance, according to the Insurance Information Institute, an industry group. That would place a rough estimate of agents’ commissions — including commissions to small-time agents as well as to brokers who sell large commercial policies — at $50 billion.

And while it might seem like an odd match for Google, whose projects include driverless cars, delivery drones and a pill to detect cancer, the key to insurance is having lots of data about people’s backgrounds and habits, which is perhaps the company’s greatest strength.

“They have a ton of data on where people drive, how people drive,” said Jon McNeill, chief executive of Enservio, a Needham, Mass., company that makes claims-processing software. “It’s the holy grail of being able to price auto insurance correctly.”

In the decades before the search engine, insurance companies used on-the-ground agents to extend their reach from financial centers to towns and neighborhoods across America. Now that power has shifted to the Internet. People have become conditioned to entering reams of personal data into a computer, and companies are better at processing it.

Robert P. Hartwig, president of the Insurance Information Institute, says rumors of the insurance agent’s death have been greatly exaggerated. Online insurance shopping is already a crowded space, which in addition to comparison portals includes the powerful marketing arms of companies like Geico and Progressive. These businesses do not just advertise insurance, but provide it too.

“Even if they go through Google or another portal, they still end up at an insurance agency or company at some point,” Mr. Hartwig said. “I think the agency model has a lot more consistency than many people give it credit for.”

D. J. Rodrian, a second-generation owner of Rodrian Insurance in Brookfield, Wis., is at least paying attention. “It should worry any agent when a megacompany like Google, with all the personal information that they have about people, is getting into your industry,” he said.

While Mr. Rodrian said he was not worried about going out of business, he said his most vulnerable customers were the quarter or so of policyholders who carry only auto insurance. Many of his other clients have comprehensive policies that are woven into everything they own, which makes them far less likely to leave.

“Consumers don’t have a great understanding of insurance,” Mr. Rodrian said. “They don’t find it an interesting thing to educate themselves about. They do get comfort in the advice of a professional.”

And, of course, just because something is possible does not mean consumers will embrace it.

Overstock offers auto and homeowners insurance, as well as commercial policies for small businesses, such as a liability policy for a ballet studio. Patrick Byrne, the company’s chief executive, says it has not done very well: While customers who go all the way through the process are very likely to buy a policy, many are unwilling to even begin the application.

Mr. Byrne said his company has sold only a few thousand policies since introducing its insurance business nine months ago, or “the equivalent of a small-town brokerage.” “It hasn’t done a whole lot of business,” he said. “But if the whole industry moves this way, it could.”

Technology companies are not the first to try to cut intermediaries out of insurance sales. That distinction belongs to the insurance trade itself, which spends billions of dollars a year on direct advertising to consumers. Behind those clever Geico television commercials involving geckos and cave men is a pitch that goes: If you buy from us instead of an agent, we will give you a discount.

That offer has worked. The direct sales channel accounted for 28 percent of United States auto insurance sales in 2012, roughly double the level in 1995, according to A. M. Best, an Oldwick, N.J., credit rating agency focused on the insurance industry.

Big insurers, having spent billions in advertising dollars to convince consumers that their insurance is cheaper than the other companies, may not embrace the comparison model. But insurance industry specialists suspect that, over time, they may have little choice.

They contend that the vast reach of search engines, combined with cheap processing power that lets even tiny companies run extensive background checks, will erode the advantage of large-scale advertising.

“As comparison begins to take off, the little guys will get exposure to consumers that they could never get on their own,” said Andrew Rose, chief executive of Comparenow.

It's Official: Earth has Warmest Year on Record in 2014

1/19/2015 (Permalink)

Reprinted from Newsday

Long Islanders who lived through last winter's recurring deep-dive Arctic dips may find it hard to believe that, globally, 2014 was the warmest year since records started being kept, back in 1880. Both NASA and the National Oceanic and Atmospheric Administration according to analyses report that Friday.

Globally, the average combined land and sea surface temperature of 58.24 was 1.24 degrees above the 20th century average and was the highest on record, NOAA said.

"This is the latest in a series of warm years, in a series of warm decades," said Gavin Schmidt, director of NASA's Goddard Institute of Space Studies.

"While the ranking of individual years can be affected by chaotic weather patterns," he said, "the long-term trends are attributable to drivers of climate change that right now are dominated by human emissions of greenhouse gases."

In 2014, Long Island was "a little on the warm side" and certainly not "record-breaking," said Jessica Spaccio, a climatologist with the Northeast Regional Climate Center based at Cornell University.

Last year's average temperature for the Island, which makes up the bulk of NOAA's New York Coastal Climate Division 4, was 52 degrees, making it the 33rd-warmest year since 1895, when records started being kept. The average yearly temperature, based on data since 1895, is 51.2, she said.

Long Island MacArthur Airport saw a 2014 average temperature of 52.5, making it the 14th-warmest year since 1984, when data started being kept, she said. The airport's December temperature, 39.6, ranks at ninth warmest for the month.

Of course, this is one small region of a planet, she said, that has been seeing an ongoing trend of being warmer than average.

Last year's heat was driven by record warmth in the world's oceans that didn't just break old marks: It shattered them. Record warmth spread across far eastern Russia, the western part of the United States, interior South America, much of Europe, northern Africa and parts of Australia.

"Every continent had some aspect of record high temperatures" in 2014, said Tom Karl, director of NOAA's National Climatic Data Center.

Nine of the 10 hottest years in NOAA global records have occurred since 2000. The odds of this happening at random are about 650 million to 1, according to University of South Carolina statistician John Grego. Two other statisticians confirmed his calculations.

Warmup Awaits Midwest, East During Mid-January

1/14/2015 (Permalink)

By Alex Sosnowski, Expert Senior Meteorologist, AccuWeather.com

Despite some pockets of cold air in the Midwest and East into the middle of this week, the wheels of change are in the works for a mild weather pattern for the middle of January.

A storm brought a reinforcing shot of cold air during the early part of the week for the Central and Eastern states. However, the jet stream is about to lock out arctic cold for the third week of the month in all but the upper Great Lakes to northern New England.

The jet stream is a high-speed river of air high above the ground that guides storms and air masses along across the globe.

According to Paul Pastelok, AccuWeather.com chief long-range meteorologist, "During the next week or so, the jet stream will set up in such a way as to keep arctic air bottled up across central and northern Canada and will allow mild Pacific air to flow from west to east across much of the United States."

Pastelok stated that there will still be some sneaky cold that skirts the northeastern states at times and that people in this area should not expect temperatures to be warm for the entire middle part of the month.

High temperatures may average 5 to 10 degrees Fahrenheit above normal in the northern tier states for a few days into next week, compared to the consistent 10 to 20 degree below normal temperatures during the first full week of January.

In areas from Chicago to Boston and New York City, this will translate to multiple days with highs in the upper 30s F to 40s F. In areas from Dallas to Atlanta, the upcoming pattern will bring highs in the 50s and 60s on at least several days. From Minneapolis to Buffalo, New York, highs will reach or exceed the freezing mark for a couple of days or more.

The last area to warm up, or the area that shows the most resistance to the warmup will be northern Michigan, upstate New York and northern New England.

Temperatures to Moderate This Week

A frigid pattern brought a shivering end to last week but the weather pattern is now in transition this week.

The cold air that poured into the East will continue to depart through the remainder of the week. Pockets of cold air will be more stubborn to leave where there is a large snowpack on the ground. During the second half of the week, the pattern will feature near-normal temperatures most days in most locations from the Midwest to the East and South.

When Will Arctic Air Return?

The expanding warmup forecast does not mean that winter is over.

"We expect much colder air to expand southward and then eastward during the fourth week in the month," Pastelok said.

Snow Versus Ice, Rain Just a Matter of Timing

Thus far this winter, cold air and storms have remained out of sync to get a major snowfall in the Interstate-95 corridor of the Northeast.

"Storm systems pushing into the Southwestern states have caused an area of high pressure to bulge northward in the Caribbean and southwest Atlantic," Pastelok said.

This has forced stronger storms to track toward the Great Lakes and weaker storms to limp off the southern Atlantic coast.

"In order for there to be be more substantial snow and ice in the coastal mid-Atlantic and southern New England, we would need cold air to come in and hold its ground as a storm is approaching, rather than give up like we have been seeing," Pastelok added.

All it would take is one or two storms to come along with just the right amount of cold air in place for locations in the mid-Atlantic and southeastern New England to receive near-average snowfall for the season.

The development of a storm along the Atlantic coast on Sunday will have to be watched for the possibility of rain and snow. Another system could bring snow to part of the Midwest and Northeast around the middle of next week as cold air begins to settle southward again.

Snowfall thus far from Washington, D.C., to New York City and Boston has averaged 25 to 50 percent of normal this winter.

10 Risk Factors for Homeowners Insurance Policies

1/9/2015 (Permalink)

Reprinted from PropertyCasualty 360

Customers buy insurance to minimize their risk and make them whole should a covered loss occur. What many may not understand is that a number of factors can cause their premiums to skyrocket before a covered peril even occurs. Adjusters and claims managers handling the ensuing claims also need to be aware of these possible red flags and their impact on any settlements.

An up-to-date home inventory complete with photos can be a major asset to any claim. Encourage owners to take a digital tour of every room to record furniture, electronics, antiques, works of art, family heirlooms and other irreplaceable items in the home. After a fire or major flood, it can be difficult to identify valuable items from their pre-loss condition.

The photos and a detailed inventory should be stored off-site in a safe deposit box or other secure location and copies provided to the insurance agent to ensure they are added to the appropriate policy. Keeping them on the computer at home won’t help if the computer is destroyed in a fire or stolen in a robbery.

A similar tour of the outside of the home can capture possible risks like trees near the house, foundation issues or possible roofing problems, as well as assets like copper gutters and other aftermarket finishes that add value to the home.

According to the Insurance Information Institute (I.I.I.), in 2012, 97.6% of the claims filed involved property damage, including theft, and jewelry was the top claims category under homeowners policies in 2011. From 2008-2012, I.I.I. says 7.3% of insured homes had a claim and the average loss was $8,255.

Here are 10 factors (not in any particular order) that can make a homeowner’s property a greater risk to insure:

Pets - Not every dog is man’s best friend and some insurers don’t take kindly to all breeds. Owning a German shepherd, Great Dane, Siberian Husky, Doberman, Rottweiler, Pit Bull, Akita or any other dog that could be considered aggressive could raise insurance rates. “This isn’t only limited to dogs, as exotic animals such as tigers, monkeys and others may cause rates to be high, if you can even get insurance,” says insurance expert Chris Tidball.

Bad credit score - Insurers will look to see if a homeowner has paid her bills on time and check credit scores. A lower number could result in higher premiums.

Location, location, location - Just like in real estate, the location of the home really does matter. Owners of homes located in Tornado Alley, along coastal Florida (or any coast for that matter), in a hurricane-prone state or in an area known for sinkholes can expect to pay more for homeowners' coverage.

Trampolines - Although exercise is important, some exercise equipment can impact insurance rates. Trampolines result in approximately 92,000 hospital visits each year. Parents frequently are unaware that they cause spinal injuries, fractures and head injuries. Most injuries are not caused by children flying off the trampoline, but because one child lands on another when they are jumping or they try something silly like riding a bike and jumping. Doctors recommend that only one child at a time be on a trampoline with adequate supervision

Swimming pools - Another source of higher homeowner insurance rates involves swimming pools. According to Parents magazine, drowning takes more than 1,000 lives a year and more than half of these events take place in the children’s own home and one-third take place in the homes of friends and relatives.

Fire concerns - Location also matters when it comes to fire stations. Living too far away from the local fire hall or a fire hydrant could raise insurance rates. Of course, a neighbor’s pool could be a source of water in an emergency, as well as a nearby pond.

Poor maintenance - Owners who don’t keep up with their home maintenance may see their rates raised or their homeowners insurance cancelled altogether. Leaky roofs, old hot water heaters, dripping pipes and poor water seals are just some of the items to watch out for. In 2012, 17.5% of the losses claimed were related to water damage and freezing pipes.

Weather preparations - Being ill-prepared for bad weather can also impact homeowners insurance rates. “In some states such as Florida, a homeowner can have a qualified wind inspection that demonstrates the ability of the insured structure to withstand certain force winds, which can result in a discount,” explains Tidball.

Claim frequency - Insureds who make multiple claims may be viewed as a higher risk and charged accordingly. Damage from a burst pipe, a tree that lands on the roof, or a kitchen fire on the same property will raise a red flag and cause insurers to take a closer look.

Neighborhood crime - “Living in a high crime area has been tied to an increase in certain types of claims, such as robbery,” says Tidball. “Rates will be assessed accordingly.” Approximately one in 190 insured homes have a property damage claim related to theft each year according to the I.I.I. And, based on I.I.I. figures from 2011, rates for homeowners insurance are highest in Florida, Texas, Louisiana, Mississippi, and Oklahoma. Idaho, Oregon, Utah, Wisconsin and Washington have the lowest rates.

They tried what? You'll never believe these 5 nutty claims stories

1/7/2015 (Permalink)

Reprinted from Property Casualty 360

Like emergency room doctors, cops and priests in the confessional booth, insurance people are being asked to clean up the messes that people make--and worse, they’re expected to pay for them.

It’s little wonder that veteran insurance people can get a bit jaded. When it comes to claims--and human nature--they have seen everything.

We spoke with several long-time insurance professionals about the weirdest claims they’ve come across in their careers. Here are some of the strangest.

1. The case of the vanishing gold bars

Claims consultant Chris Tidball has worked for P&C carriers for more than 20 years, in roles ranging from claims adjusting to management. The client whom he recalls as the “biggest nut” was Walter A., who presented a claim for a stolen van that was carrying $500,000 in gold bars, which, of course, he wanted covered as well. “Imagine our shock when the van turned up burned to a crisp and all the gold was missing.” Walter would personally come to the office every morning at 8 a.m. to demand his check—a ritual that continued for around 90 days. “He would come in and get belligerent, then would feign having a heart attack, asking us to help him find his nitro pills. He was truly certifiable.”

2. The case of the gypsy curse

Another Tidball tale involves a gypsy who roamed around Southern California. This gypsy had a van that he reported stolen that, like Walter’s, contained lots of valuable “stuff,” which the gypsy could somehow never describe beyond saying it was important. When Tidball told him he had to deny the claim (which was “complete and utter B.S.”) the case went to trial. During an examination under oath, the gypsy pointed a magician’s wand at Tidball and started speaking a strange language in an attempt to cast a curse on the insurance man.

3. The case of the cruising cat ladies

Steve Schroeder, vice president of NFP, has been in the property-casualty business for almost 25 years, on both the broker and carrier side. One of his most memorable claims cases involved a trucking-company client that had a claim filed against a driver. The claimant alleged the truck hit a station wagon and injured the driver and her passenger. The truck driver insisted that it wasn’t his fault; the vehicle had appeared out of nowhere. Investigating state police and SIU personnel found no truck skid marks, but several dead cats on the highway at the accident site. It turned out the women, whose station wagon had been loaded with cats, had been literally driving in circles in the rural area – first in the southbound lane, then crossing the embankment and heading north. When the truck driver T-boned the station wagon, several cats flew out the vehicle’s windows and were killed. The claim was pulled.

4. The case of the soaked survivalists

Schroeder recalls another case where the elderly owners of an older but newly renovated home made a $350,000 water-damage claim after heavy rains and an inadequate sump pump ruined what they described as thousands of “valuable items” in their storage area. After a closer investigation by the claims adjuster, it turned out the storage area was actually a bomb shelter dating back to the Cold War era that the couple kept secret from family and friends. Stuffed in this shelter were thousands of meticulously arranged items set aside for an apocalypse—soap, toothpaste, canned goods and more. The owners claimed these items were worth hundreds of thousands of dollars, even though most of the items were useless. The ins

5. The case of the conniving construction workers

Schroeder recalls a contractor client that filed a claim involving the death of a foreman on the building site of an eight-story apartment complex. A team of four had been loading a huge pipe onto the top floor of the structure when the foreman fell and was killed. His three coworkers all insisted that the crane operator was at fault, although the operator denied this. The claim went to mediation and was set to settle for $3.2 million. All parties were at the meeting and ready to sign the paperwork when the foreman’s widow whispered to Schroeder that she had to speak with him immediately. After going to a private room, she told Schroeder that she wanted all of the settlement money to be placed into a structured settlement for her two children, ages 2 and 4. It turned out that her deceased husband was not well liked by the crew, two of which had proposed marriage to the widow, knowing the death settlement would make her a millionaire. However, the police could not prove foul play so the case had to settle.urer ended up paying around $200,000 to settle the claim.

Trash Can Still Be Treasure When Properly Restored

1/5/2015 (Permalink)

Adjusters didn’t always think about how many items could be easily restored for a reasonable cost. With their eyes opened to the ease and benefits of restoration, they would be amazed at how frequently salvageable items are tossed away as trash. When items like furniture, cabinets, millwork, fireplace mantles, and hardwood floors can be repaired and restored, insurers can save money over complete replacement and owners are usually thrilled that their treasure has been restored.

Adjusters who know about the expertise available and benefits of repair and restoration over replacement can effectively boost their bottom line and have more satisfied clients. The education process includes learning the options… it’s not just furniture that can be restored, but dinged walls from moving, spills, puppy chews, scratched leather, chair caning, cabinets and more. If ever in doubt about whether it can be fixed, simply ask.

Customers are typically overjoyed when we can restore a family heirloom because we all know you just can’t put a price on sentimental, one-of-a-kind items. When adjusters call to see if there’s anything we can do to save a treasure from the trash, usually the answer is “yes.”

A Recap of Long Island's Year in Weather

12/31/2014 (Permalink)

Reprinted from Newsday

Record rainfall on one August day this year may not have had an Islandwide impact, but it stands out to meteorologists as one for the textbooks, as well as the top of Long Island's 2014 weather highlights list.

"Meteorologically, it was almost unbelievable . . . I'm still amazed," Jeffrey Tongue, National Weather Service meteorologist, said of the 13.57 inches of rain that fell at Long Island MacArthur Airport Aug. 12-13. The deluge broke the state's previous 24-hour record of 11.6 inches falling in Tannersville when Tropical Storm Irene swept through in 2011.

That torrent headlined a 2014 that also included the dramatic temperature swings of January and February and a stretch of snowstorms that seemingly would not end, along with a mild summer that did not see any 90-degree days.

As for that 24-hour August rainfall -- deemed a 200-year storm event by the Northeast Regional Climate Center -- 5.34 inches alone fell from 5 to 6 a.m. on Aug. 13 at the airport, followed by another 4.37 inches the following hour, according to the climate center. They may have come back to back, but each is considered a 500-year event, said Jessica Spaccio, a climatologist with the center, based at Cornell University. That means that hourly rainfall of such magnitude would be expected just once in a 500-year period.

Working the morning shift that day was David Stark, a weather service meteorologist based in Upton, who knew significant rain was coming as the weather service had been issuing flash flood watches and warnings. But when he saw the magnitude, he thought, "Whoa. Is this really happening?"

At play, Stark said, was the convergence of several factors -- an atmosphere "loaded with moisture," along with mechanisms, including a micro-scale low pressure area,that lifted up the warm, moist air, which was then wrung out over central Long Island, where the whole system had stalled.

The result was "a traffic nightmare," he said -- flooded streets, stranded motorists, full-to-partial closures of major roadways, as well as flooded yards and basements and the opening up of various sinkholes. Impacted primarily was a diagonal strip from the southwestern tip of Suffolk up to around the Coram area, he said.

Affecting the entire Island and over a much longer time frame was a pattern early in the year of frigid days, some wide temperature swings and, at one point, snowstorms coming through like clockwork every few days.

January's snowfall at the airport amounted to 25.2 inches, a far cry from the norm of 6.7 inches, according to weather service data, with February seeing 24.5 inches compared with the 7.1 inch norm.