Insurance via Internet Is Squeezing Agents

1/19/2015 (Permalink)

Reprinted from The New York Times

To the list of jobs threatened by the Internet, add one more: insurance agent.

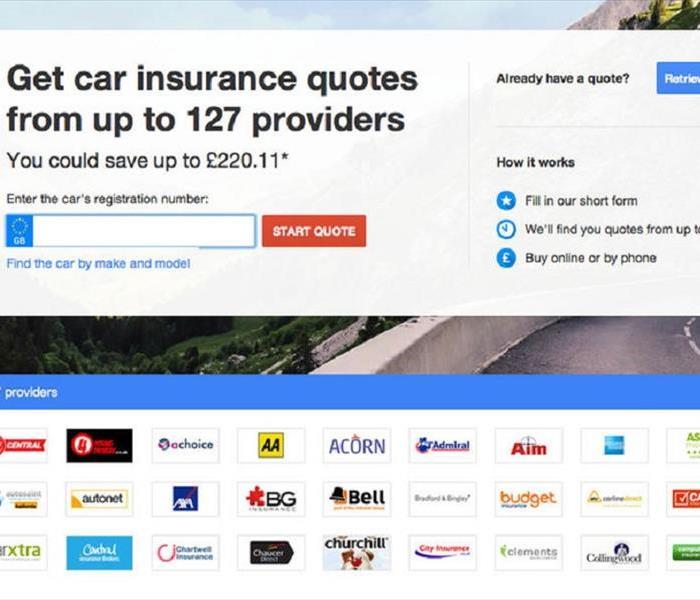

Technology start-ups, and companies from the insurance industry, are introducing websites that sell or promote a range of insurance including auto, homeowners and small commercial policies. These portals, which promise savings by showing consumers many price quotes so they do not have to shop site by site, are putting pressure on insurance agents, who collect 10 percent or more of their policyholders’ payments.

Online insurance comparison is still a nascent business, and it has yet to make a dent in the armies of intermediaries that are the backbone of the trade. But people in the industry and Silicon Valley say it is only a matter of time. Even Google is getting involved.

“There are 40,000 agencies in the U.S., and you could absolutely imagine them shrinking by a quarter, and the ones that are left will deal with more complicated needs and more affluent customers,” said Ellen Carney, an analyst who covers insurance for Forrester Research.

The idea of selling insurance online is not new. Lately, though, the boring but lucrative trade has been attracting big names. The most recent is Google.

Its Google Compare auto insurance site (basically a search engine for auto insurance prices) has been operating in Britain for two years, and Google is working on something similar for the United States. Google is licensed to sell insurance in about half of the states, according to research by Ms. Carney.

Google has formed a partnership with Comparenow, an American auto insurance comparison site owned by Admiral Group, a British car insurance company that has operated a European price-comparison site for more than a decade. The venture will give Google access to insurers in Comparenow’s network.

Admiral Group introduced Comparenow about a year ago. Not long after, Overstock.com, a retailer, started selling auto and other forms of insurance.

Then there is Walmart, which does not sell insurance but recently formed a partnership with AutoInsurance.com. The insurer leases space in Walmarts, giving it access to the 140 million people who shop there each week.

These companies are joining start-ups like CoverHound, a San Francisco company that allows consumers to compare and buy auto insurance online, and PolicyGenius, a Brooklyn company that sells products including life, renters and pet insurance.

Some companies, like CoverHound and PolicyGenius, are online insurance agencies. Others, like Comparenow, send traffic to insurers and get a finder’s fee whenever someone buys a policy. But in all cases, they are pressing Main Street agents by automating the process and showing insurers’ prices side by side.

“A lot of people are waking up to the fact that it’s a massive industry, it’s old-fashioned, they still use human agents and the commissions are pretty big,” said Jennifer Fitzgerald, the founder and chief executive of PolicyGenius. “It’s ripe for — I hate to use the word — disruption.”

Insurance is a fat target. In 2013, insurers wrote $481 billion in premiums for property and casualty insurance, which consists of mostly auto, home and commercial insurance, according to the Insurance Information Institute, an industry group. That would place a rough estimate of agents’ commissions — including commissions to small-time agents as well as to brokers who sell large commercial policies — at $50 billion.

And while it might seem like an odd match for Google, whose projects include driverless cars, delivery drones and a pill to detect cancer, the key to insurance is having lots of data about people’s backgrounds and habits, which is perhaps the company’s greatest strength.

“They have a ton of data on where people drive, how people drive,” said Jon McNeill, chief executive of Enservio, a Needham, Mass., company that makes claims-processing software. “It’s the holy grail of being able to price auto insurance correctly.”

In the decades before the search engine, insurance companies used on-the-ground agents to extend their reach from financial centers to towns and neighborhoods across America. Now that power has shifted to the Internet. People have become conditioned to entering reams of personal data into a computer, and companies are better at processing it.

Robert P. Hartwig, president of the Insurance Information Institute, says rumors of the insurance agent’s death have been greatly exaggerated. Online insurance shopping is already a crowded space, which in addition to comparison portals includes the powerful marketing arms of companies like Geico and Progressive. These businesses do not just advertise insurance, but provide it too.

“Even if they go through Google or another portal, they still end up at an insurance agency or company at some point,” Mr. Hartwig said. “I think the agency model has a lot more consistency than many people give it credit for.”

D. J. Rodrian, a second-generation owner of Rodrian Insurance in Brookfield, Wis., is at least paying attention. “It should worry any agent when a megacompany like Google, with all the personal information that they have about people, is getting into your industry,” he said.

While Mr. Rodrian said he was not worried about going out of business, he said his most vulnerable customers were the quarter or so of policyholders who carry only auto insurance. Many of his other clients have comprehensive policies that are woven into everything they own, which makes them far less likely to leave.

“Consumers don’t have a great understanding of insurance,” Mr. Rodrian said. “They don’t find it an interesting thing to educate themselves about. They do get comfort in the advice of a professional.”

And, of course, just because something is possible does not mean consumers will embrace it.

Overstock offers auto and homeowners insurance, as well as commercial policies for small businesses, such as a liability policy for a ballet studio. Patrick Byrne, the company’s chief executive, says it has not done very well: While customers who go all the way through the process are very likely to buy a policy, many are unwilling to even begin the application.

Mr. Byrne said his company has sold only a few thousand policies since introducing its insurance business nine months ago, or “the equivalent of a small-town brokerage.” “It hasn’t done a whole lot of business,” he said. “But if the whole industry moves this way, it could.”

Technology companies are not the first to try to cut intermediaries out of insurance sales. That distinction belongs to the insurance trade itself, which spends billions of dollars a year on direct advertising to consumers. Behind those clever Geico television commercials involving geckos and cave men is a pitch that goes: If you buy from us instead of an agent, we will give you a discount.

That offer has worked. The direct sales channel accounted for 28 percent of United States auto insurance sales in 2012, roughly double the level in 1995, according to A. M. Best, an Oldwick, N.J., credit rating agency focused on the insurance industry.

Big insurers, having spent billions in advertising dollars to convince consumers that their insurance is cheaper than the other companies, may not embrace the comparison model. But insurance industry specialists suspect that, over time, they may have little choice.

They contend that the vast reach of search engines, combined with cheap processing power that lets even tiny companies run extensive background checks, will erode the advantage of large-scale advertising.

“As comparison begins to take off, the little guys will get exposure to consumers that they could never get on their own,” said Andrew Rose, chief executive of Comparenow.

24/7 Emergency Service

24/7 Emergency Service